In the age of digital transformation, the public blockchain stands at the forefront of the revolution. Public blockchain technology is the underlying infrastructure for cryptocurrencies and decentralized finance (DeFi). It has created a new era of transparency, security, and autonomy for financial transactions and data sharing across various sectors. In this article, we’ll explore the structure, advantages, use cases, and challenges of public blockchain technology, while also diving deep into its role in powering cryptocurrencies and DeFi applications.

Key Takeaways:

- Public blockchains are decentralized, transparent, and secure, making them ideal for cryptocurrencies and decentralized finance (DeFi).

- They offer several advantages, including trustlessness, immutability, and global accessibility.

- Public blockchains face challenges, such as scalability and energy consumption, but advancements like Proof of Stake are addressing these issues.

- The future of public blockchain is promising, with increasing adoption across industries and the rise of Web3 technologies.

What is a Public Blockchain?

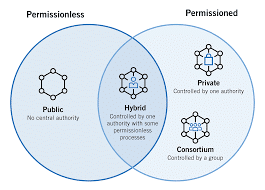

A public blockchain is a type of blockchain that is decentralized, transparent, and permissionless. It operates as an open, distributed ledger that allows anyone to join and participate in the network, either by validating transactions or simply by accessing and viewing the data stored within the blockchain. Unlike private or consortium blockchains, which are controlled by a single organization or a group of entities, a public blockchain is operated by a decentralized network of nodes (computers), each of which maintains a copy of the entire blockchain.

In a public blockchain, the key concept is decentralization. There is no central authority or intermediary that oversees the network’s operations. Instead, the consensus of the participants in the network ensures the integrity of the system. This decentralized nature makes public blockchains highly secure and resistant to tampering, censorship, or central control.

Key Characteristics of Public Blockchains

- Open and Transparent: One of the most important features of public blockchains is their openness and transparency. Anyone can view the entire history of transactions stored on the blockchain. The data is publicly accessible, allowing for complete transparency. This feature is crucial for building trust, as anyone can verify the authenticity and validity of the data without relying on a third-party authority.

- Permissionless: Public blockchains are permissionless, meaning that there are no restrictions on who can join the network. Anyone with an internet connection can participate, whether by sending transactions, verifying transactions, or running a full node to help maintain the integrity of the network. This is in contrast to private blockchains, which require specific permission or authorization to access.

- Decentralization: Public blockchains are decentralized in nature, meaning that there is no central point of control. The network is distributed across multiple nodes (computers) that are spread out geographically. Each node stores a full or partial copy of the blockchain, and the data is verified and updated through a consensus process. This lack of central control ensures that no single entity can alter or manipulate the blockchain’s data.

- Immutability: Once a transaction is recorded on a public blockchain, it becomes immutable—meaning it cannot be altered, deleted, or reversed. This immutability is achieved through the use of cryptographic hash functions and consensus mechanisms that ensure the integrity of the data. If someone tries to alter a transaction in a block, it would change the hash of that block, breaking the link to the next block and causing a mismatch across all the copies of the blockchain. As a result, it is practically impossible to alter the history of transactions once they have been added to the blockchain.

- Security: Public blockchains are highly secure due to their decentralized nature and the use of cryptographic techniques. Transactions are verified by a network of nodes using consensus mechanisms like Proof of Work (PoW) or Proof of Stake (PoS). These consensus algorithms ensure that only valid transactions are recorded and prevent fraudulent activities like double-spending. Additionally, the use of cryptographic keys ensures that only authorized participants can access and control their assets.

- Consensus Mechanisms: Consensus mechanisms are protocols used by public blockchains to agree on the state of the network and validate transactions. The two most common consensus mechanisms used in public blockchains are:

- Proof of Work (PoW): In PoW, participants (miners) compete to solve complex mathematical puzzles. The first miner to solve the puzzle is rewarded with the opportunity to add a new block to the blockchain. Bitcoin, the first and most well-known cryptocurrency, uses PoW as its consensus mechanism.

- Proof of Stake (PoS): PoS works by allowing participants (validators) to create new blocks and validate transactions based on the number of cryptocurrency tokens they hold and are willing to “stake” or lock up as collateral. Ethereum, after transitioning from PoW to PoS, now uses this method for block validation.

Examples of Public Blockchains

- Bitcoin (BTC): Bitcoin is the most famous example of a public blockchain. It was the first cryptocurrency to implement blockchain technology and uses a PoW consensus mechanism to validate transactions. Bitcoin transactions are publicly visible on the blockchain, and anyone can participate in the network by running a node or mining new blocks. Bitcoin’s public blockchain ensures that all transactions are transparent and cannot be altered once they are confirmed.

- Ethereum (ETH): Ethereum is another popular example of a public blockchain. Ethereum goes beyond cryptocurrencies and allows for the creation and execution of smart contracts—self-executing contracts where the terms of the agreement are written directly into the code. Ethereum initially used PoW, but it has since transitioned to PoS with its Ethereum 2.0 upgrade. Ethereum’s public blockchain enables decentralized applications (dApps) and decentralized finance (DeFi) platforms to be built on top of it.

- Litecoin (LTC): Litecoin is another public blockchain that is similar to Bitcoin but with some technical differences. It uses a different cryptographic algorithm (Scrypt) and has a faster block generation time, allowing for quicker transaction confirmations. Litecoin also operates on a public blockchain and relies on PoW for consensus.

- Cardano (ADA): Cardano is a public blockchain that aims to provide a more secure and sustainable blockchain platform for the development of dApps and smart contracts. It uses a PoS consensus mechanism called Ouroboros, which is designed to be energy-efficient and scalable.

How Public Blockchains Work

Public blockchains operate through a series of steps that ensure the secure and transparent exchange of data. Here is a simplified breakdown of how they function:

- Transaction Creation: A transaction is initiated by a participant on the blockchain. For example, a user might want to send cryptocurrency to another user or execute a smart contract.

- Transaction Broadcasting: Once the transaction is created, it is broadcast to the network. The transaction contains the details, including the sender’s and receiver’s public addresses, the amount, and any other relevant information.

- Transaction Verification: Miners or validators on the blockchain network verify the transaction. They check that the sender has sufficient funds (in the case of cryptocurrency transactions) and that the transaction follows the blockchain’s rules.

- Block Creation: Once the transaction is verified, it is grouped together with other verified transactions into a block. The block contains a cryptographic hash of the previous block, forming a chain. This ensures that blocks are linked together in a way that cannot be tampered with.

- Consensus and Block Addition: The block is then added to the blockchain through the consensus mechanism (PoW or PoS). This process ensures that all participants in the network agree on the state of the blockchain and the validity of the transactions.

- Finalization: Once the block is added to the blockchain, the transaction is considered final and immutable. The blockchain is updated across all participants, ensuring everyone has the same version of the data.

Advantages of Public Blockchains

- Security: Public blockchains are highly secure due to the use of cryptographic techniques and decentralized consensus. The network’s distributed nature makes it difficult for bad actors to manipulate the data.

- Transparency: Since all transactions are visible to anyone on the network, there is complete transparency, making it easy for participants to verify transactions.

- Decentralization: Public blockchains do not rely on a central authority, reducing the risk of censorship or fraud.

- Immutability: Once data is recorded on a public blockchain, it cannot be altered, making it a trustworthy source of truth.

Challenges of Public Blockchains

Regulation: Public blockchains often operate in a regulatory gray area. Governments are still grappling with how to regulate decentralized networks and ensure compliance with existing laws.

Scalability: As more users join the network and transaction volumes increase, public blockchains can experience delays and higher fees. This is especially true for blockchains that use PoW, which requires a significant amount of computational power.

Energy Consumption: PoW-based blockchains, such as Bitcoin, require substantial energy consumption to maintain the network. This has raised environmental concerns.

Key Features of Public Blockchains:

- Decentralization: No central authority or single point of control.

- Transparency: All transactions are visible to anyone on the network.

- Security: Transactions are secured through cryptography and consensus mechanisms.

- Immutability: Once a transaction is added to the blockchain, it cannot be altered or deleted.

- Open-source: The code behind public blockchains is open for anyone to audit and improve.

The Role of Public Blockchain in Cryptocurrencies

Public blockchains have become the foundation for cryptocurrencies, with Bitcoin being the first and most well-known cryptocurrency to operate on a public blockchain. Bitcoin uses the blockchain to securely store its transaction data, ensuring that each transaction is irreversible and verifiable without the need for a trusted intermediary like a bank.

How Bitcoin Works on a Public Blockchain:

Bitcoin transactions are broadcasted to the public blockchain network, where miners (or validators, in PoS systems) confirm the legitimacy of the transactions. These miners compete to solve complex mathematical problems, and the first one to solve the problem is rewarded with newly minted Bitcoin and transaction fees. This process, known as Proof of Work (PoW), ensures that only valid transactions are added to the blockchain.

Because the Bitcoin blockchain is public, anyone can see the entire history of transactions, from the very first block (the “genesis block”) to the most recent ones. This transparency ensures trust in the system, as no single entity can manipulate or alter the transaction history.

Other cryptocurrencies, such as Ethereum, also use public blockchains to facilitate the exchange of value. Ethereum, however, goes a step further by enabling the creation and execution of smart contracts—self-executing contracts with the terms directly written into the code.

The Impact of Public Blockchain on Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is an emerging financial ecosystem that leverages blockchain technology to provide traditional financial services without intermediaries like banks. DeFi applications are built on public blockchains, allowing anyone to borrow, lend, trade, and earn interest on their digital assets without the need for a centralized financial institution.

Key DeFi Applications Powered by Public Blockchain:

- Decentralized Exchanges (DEXs): Platforms like Uniswap and SushiSwap allow users to trade cryptocurrencies without a centralized authority.

- Lending and Borrowing Platforms: Platforms like Aave and Compound allow users to lend their assets and earn interest, or borrow assets by collateralizing their own crypto holdings.

- Stablecoins: Stablecoins such as DAI and USDC are cryptocurrencies that are pegged to a stable asset (like the US dollar) and are built on public blockchains to facilitate price stability in the DeFi space.

- Yield Farming and Staking: DeFi protocols like Yearn.Finance and PancakeSwap allow users to stake their assets in liquidity pools and earn returns in the form of interest or rewards.

Public blockchains are essential for the success of these applications because they offer the necessary security, transparency, and decentralization that DeFi projects require. Without the trust and security provided by public blockchains, these financial services would not be able to function without relying on centralized authorities.

Advantages of Public Blockchain

1. Decentralization and Trustlessness:

Public blockchains are decentralized, meaning there is no single point of failure. Transactions are verified by a network of validators, ensuring trust in the system without the need for intermediaries.

2. Transparency:

Transactions on public blockchains are transparent and accessible to anyone. This feature promotes accountability, as anyone can verify the transaction history of any wallet address or blockchain block.

3. Security:

Public blockchains use advanced cryptographic techniques to secure transactions. Since the data is spread across multiple nodes, it is extremely difficult to tamper with the information, making public blockchains highly secure.

4. Immutability:

Once a transaction is recorded on a public blockchain, it becomes part of the permanent, unchangeable record. This feature is crucial for ensuring data integrity in applications such as finance, healthcare, and supply chain management.

5. Global Accessibility:

Since public blockchains are permissionless, anyone with an internet connection can participate in the network, access financial services, and interact with blockchain applications.

Challenges of Public Blockchain

While public blockchains offer significant advantages, they also come with challenges that need to be addressed.

1. Scalability:

Public blockchains, especially those using Proof of Work (PoW), can face scalability issues. As the number of users and transactions increases, the network can become congested, leading to slower transaction times and higher fees.

2. Energy Consumption:

Proof of Work, used by Bitcoin and other blockchains, requires significant computational power and energy consumption to secure the network. This has raised concerns about the environmental impact of blockchain technology.

3. Regulatory Uncertainty:

As public blockchains continue to gain adoption, governments and regulatory bodies are still figuring out how to regulate decentralized networks. This uncertainty can create challenges for businesses and individuals looking to use blockchain-based financial services.

4. Security Risks:

While public blockchains are highly secure, they are not immune to attacks. For example, 51% attacks, where a malicious actor controls the majority of the network’s mining power, can potentially compromise the integrity of the blockchain.

The Future of Public Blockchain

The future of public blockchain looks promising, with increasing adoption across industries such as finance, healthcare, supply chain management, and government. As more businesses and individuals turn to decentralized solutions, blockchain technology will continue to evolve.

In the coming years, we may see improvements in blockchain scalability, energy efficiency, and regulatory frameworks. Additionally, with the rise of Web3 technologies, public blockchains will likely play an even greater role in reshaping the internet into a decentralized platform where individuals have more control over their data and digital assets.

Also Read : Blockchain Explained: A Beginner’s Guide To The Revolutionary Technology

Conclusion

Public blockchain technology has revolutionized the way we think about digital transactions and decentralized systems. As the backbone of cryptocurrencies and DeFi applications, it provides a secure, transparent, and decentralized infrastructure for conducting financial transactions and data exchanges. While challenges like scalability and regulatory uncertainty remain, the future of public blockchain looks bright as it continues to evolve and reshape industries.

FAQs

What is a public blockchain?

- A public blockchain is a decentralized, permissionless network where anyone can join and participate in the validation of transactions.

How does public blockchain ensure security?

- Public blockchains use consensus mechanisms like Proof of Work or Proof of Stake to validate transactions and cryptographic techniques to secure the data.

What are the advantages of public blockchain?

- The key advantages of public blockchain include decentralization, transparency, security, immutability, and global accessibility.

How does public blockchain support cryptocurrencies?

- Public blockchains enable cryptocurrencies to function by providing a secure, transparent, and decentralized environment for transactions to occur without intermediaries.

What is DeFi, and how is it related to public blockchain?

- DeFi (Decentralized Finance) refers to financial services that are built on public blockchains, allowing users to lend, borrow, trade, and earn interest on digital assets without relying on banks or other intermediaries.

Can public blockchains be hacked?

- While public blockchains are highly secure, they are not immune to attacks. For example, 51% attacks can potentially compromise the network.

What is the future of public blockchain?

- The future of public blockchain is bright, with ongoing improvements in scalability, energy efficiency, and adoption across various industries. Blockchain technology is expected to play a central role in Web3 and decentralized applications.